Liquidity & Infrastructure Marketplace

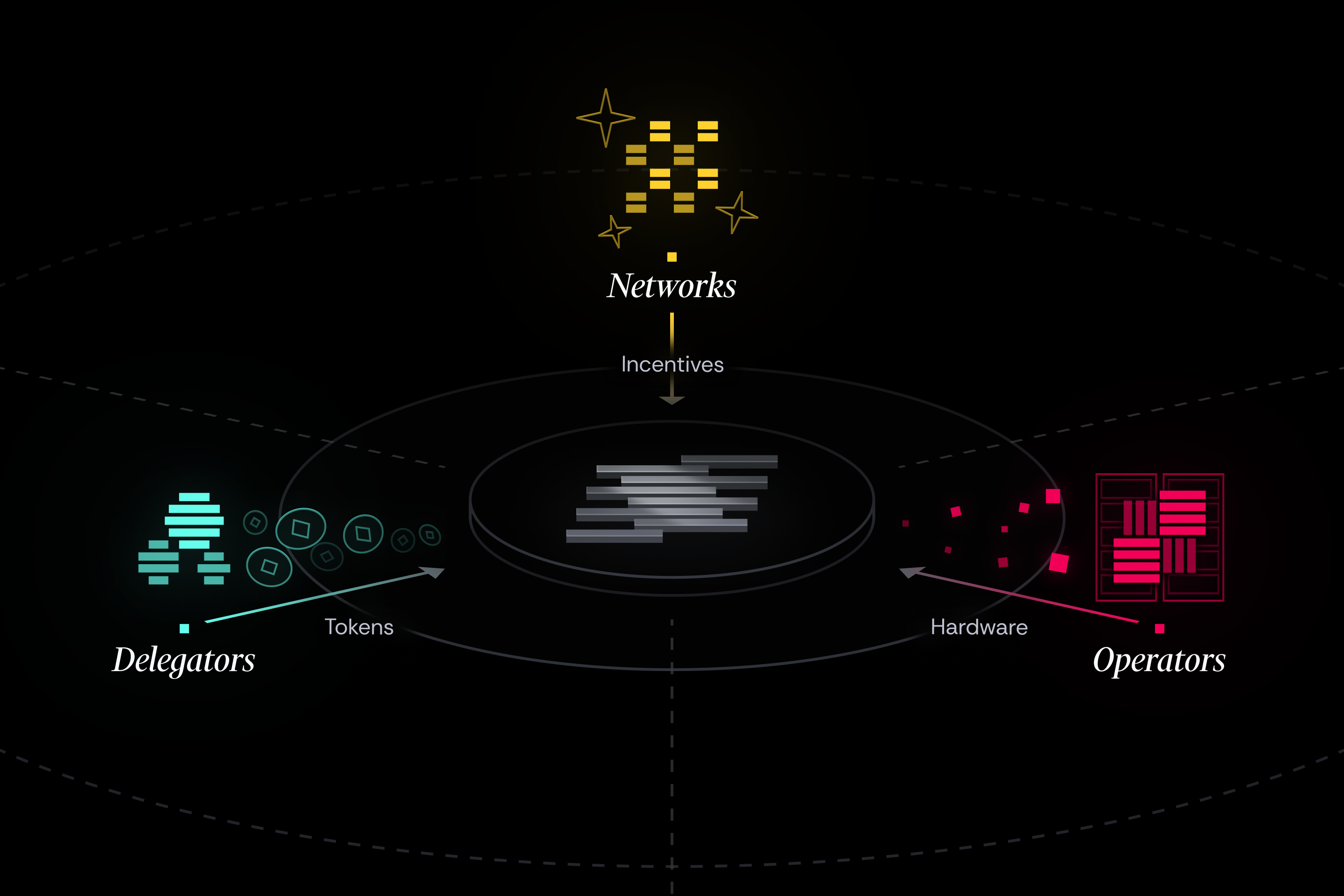

Nektar is a platform that connects participants within a modular decentralized economy to efficiently aggregate liquidity, optimize infrastructure use, and implement customized reward schemes. It allows token holders to delegate their assets, which are then used to enhance infrastructure operations for various projects.

The marketplace fosters a thriving ecosystem with four main actors:

- Networks

- Operators

- Delegators

- Managers

Onboarding:

- Define the service to be received

- Specify reward asset types (e.g. native tokens)

- Provide service rewards and penalties terms

- Register a Network and apply for whitelisting

- Provide node clients to Operators (if applicable)

Interaction:

- Receive services

- Pay for services

- Report service performance

Learn more about Networks →

Onboarding:

- Select reward assets

- Configure and deploy a Decentralized Asset Manager (DAM)

- Install Networks into DAMs

Interaction:

- Operate infrastructure for a DAM/Network

- Receive rewards

- Run nodes (if applicable)

Learn more about Operators →

Onboarding:

- Select a DAM

- Deposit assets

Interaction:

- Receive rewards

- Face penalties (if applicable)

Learn more about Delegators →

Onboarding:

- Set up a DAM

- Whitelist Operators

Learn more about Managers →

Matchmaking

Operators can join the marketplace permissionlessly, while Networks and asset types need to be whitelisted. The main matchmaking steps are:

- Operator (or DAM owner) selects Networks to be installed into a DAM

- Delegator selects DAMs to delegate its assets

Once the DAMs are fully set up, the value flow of liquidity, security, and incentives occurs as part of delivering the services.

Learn more about DAM →

Rewards

Rewards are paid by Networks for the services provided to them, and distributed to Operators and Delegators according to predefined rewards distribution criteria. When configuring a Network, the following parameters are specified for

Deposits:

- Asset type (can be any whitelisted ERC-20 token)

- Amount requested from Delegators and minimum deposit

Rewards:

- Asset type (can be a native token, as long as it is an ERC-20 on the Ethereum network)

- Distribution rate for

- Liquidity (native tokens per deposited amount)

- Operation (per days operated)

- Collateral (per days operated, if applicable)

Rewards distribution mechanism relies on automatically minted synthetic tokens.

Learn more about rewards →

Penalties

Each Network defines its own arbitrary logic for rewards, incentives, and penalties. Unlike slashed collateral, a punished party doesn’t burn assets, but rather transfers them to a vault.

Learn more about penalties →

Metrics

Key metrics on Nektar’s marketplace aim to gather information about real usage of the platform and its growth, therefore Nektar’s relies primarily on Global Traded Volume (GTV) meaning assets deposited, exchanged or distributed through the platform, as well as active daily users. TVL is not used as a main relevant metric in Nektar since locking of assets falls to the benefit of the relevant Networks interacting with Nektar’s protocol.