Liquidity use cases

Below are examples where assets are returned at the end.

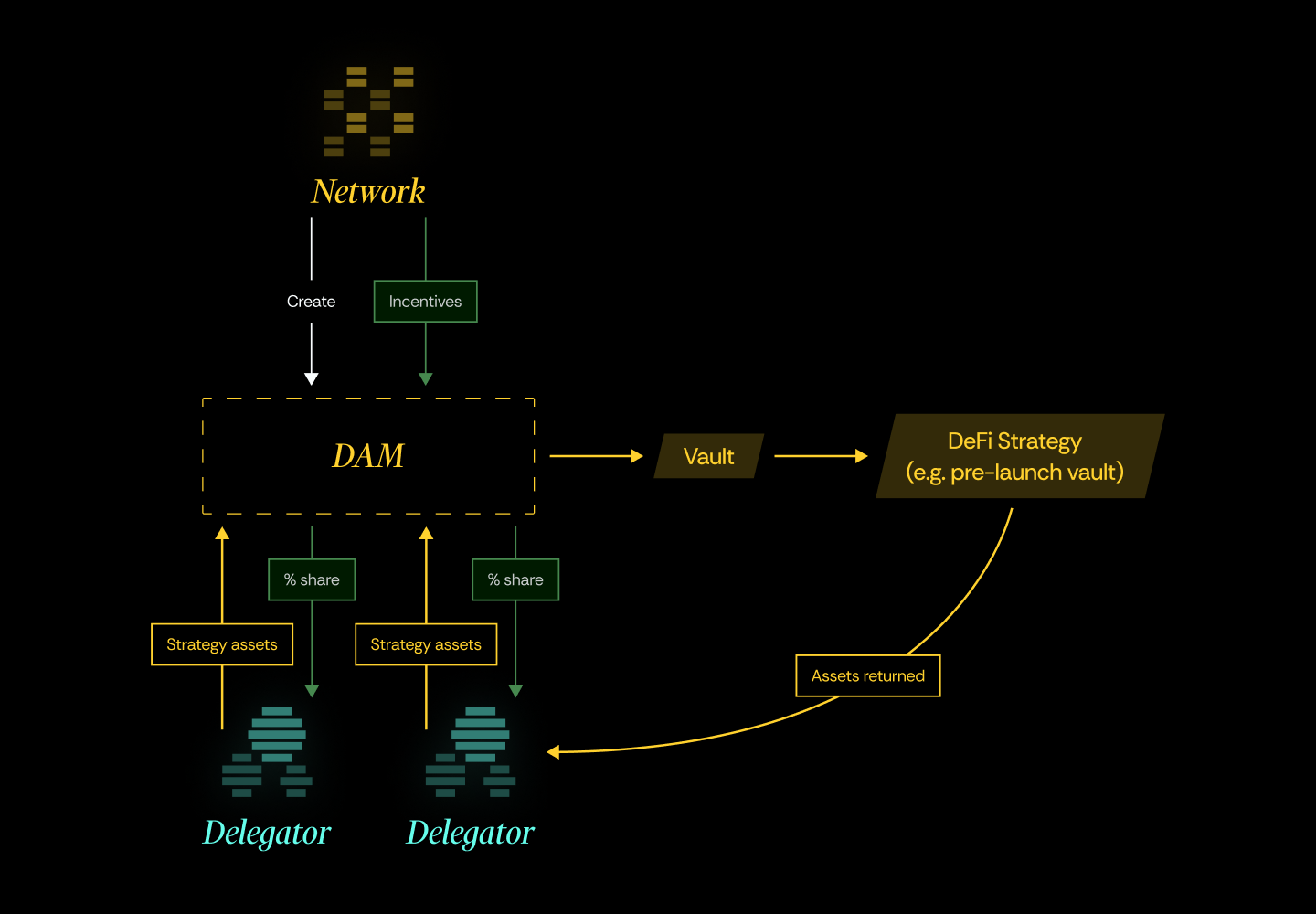

- DeFi strategy

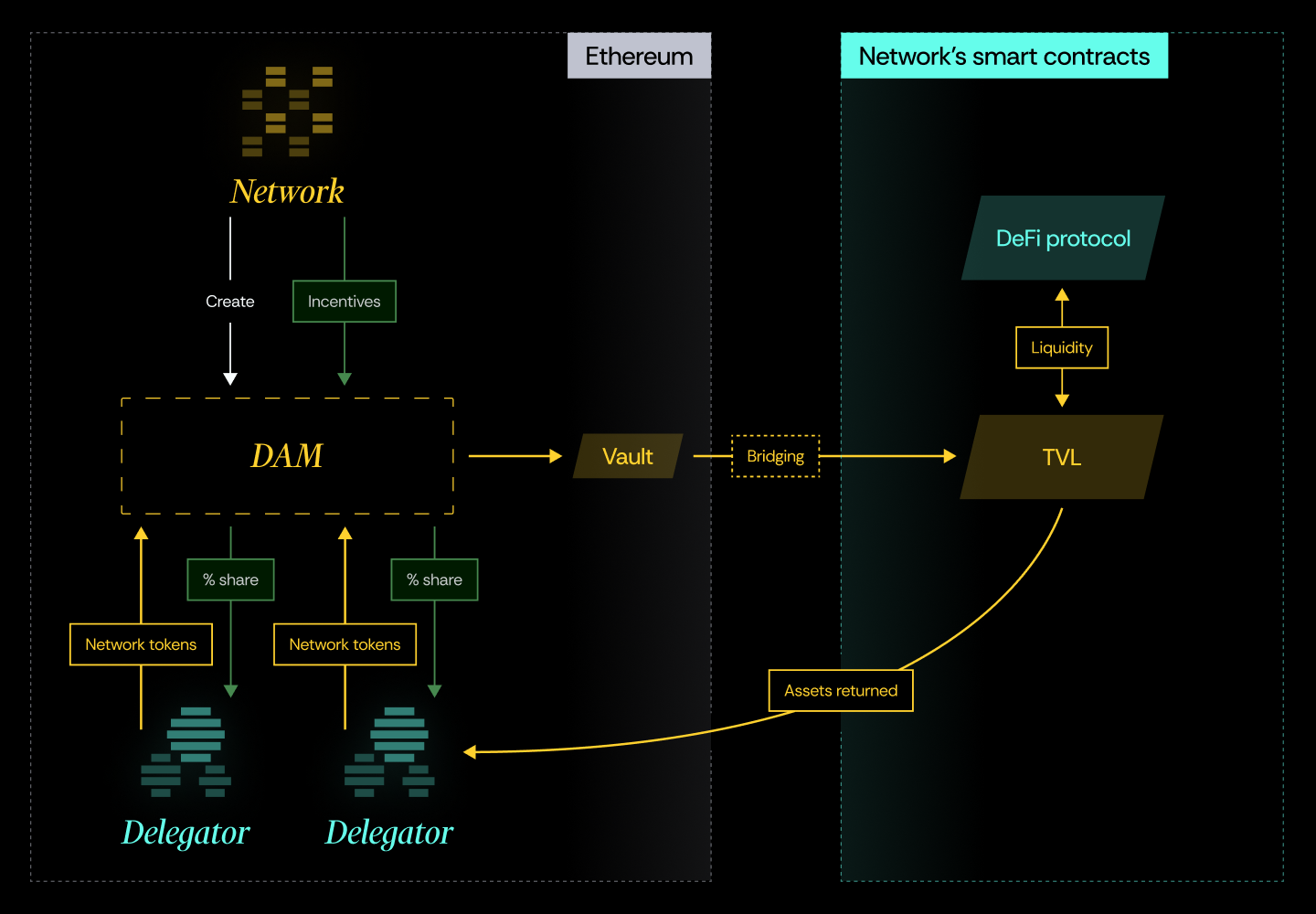

- Bootstrapping TVL

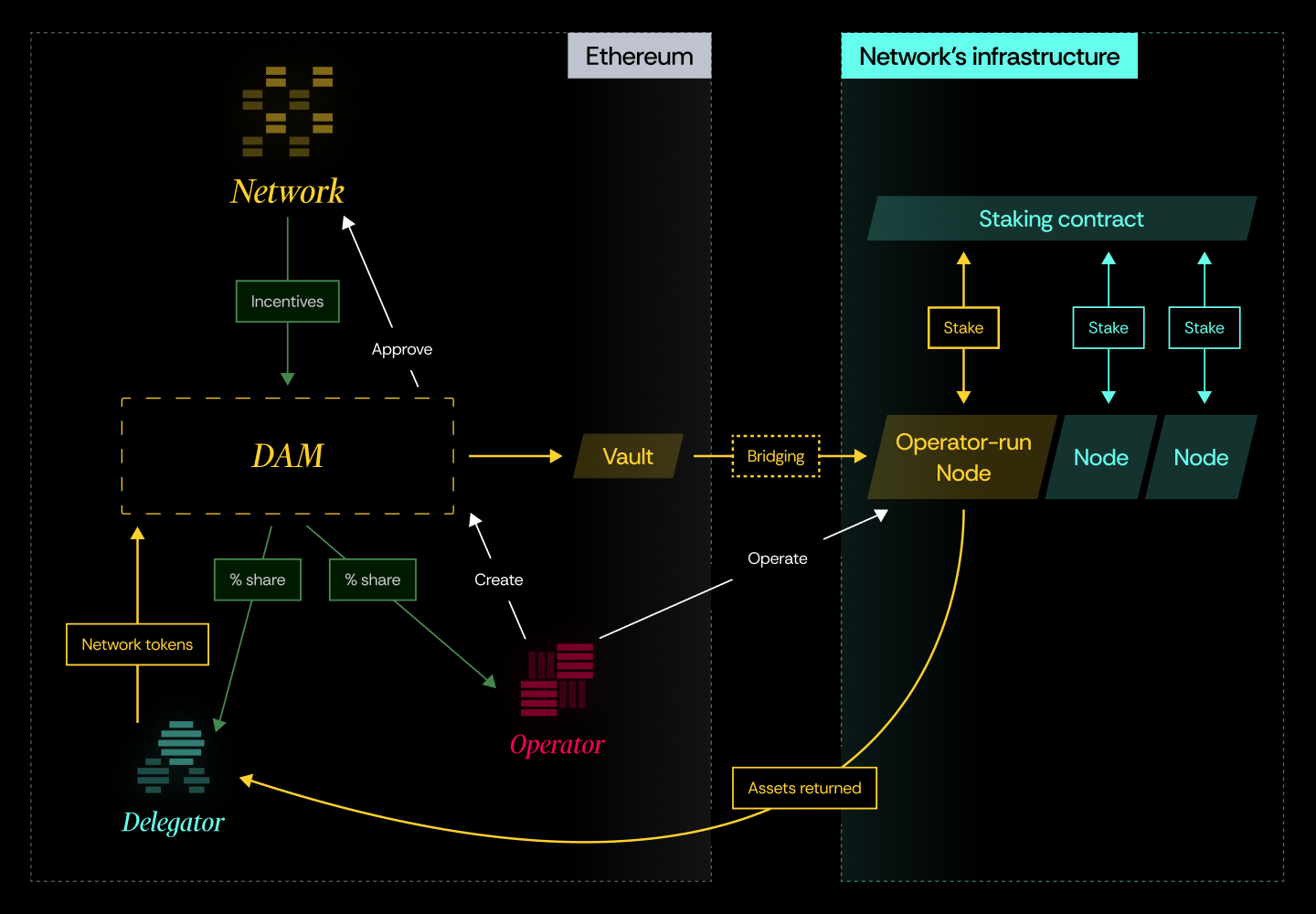

- Staking incentives

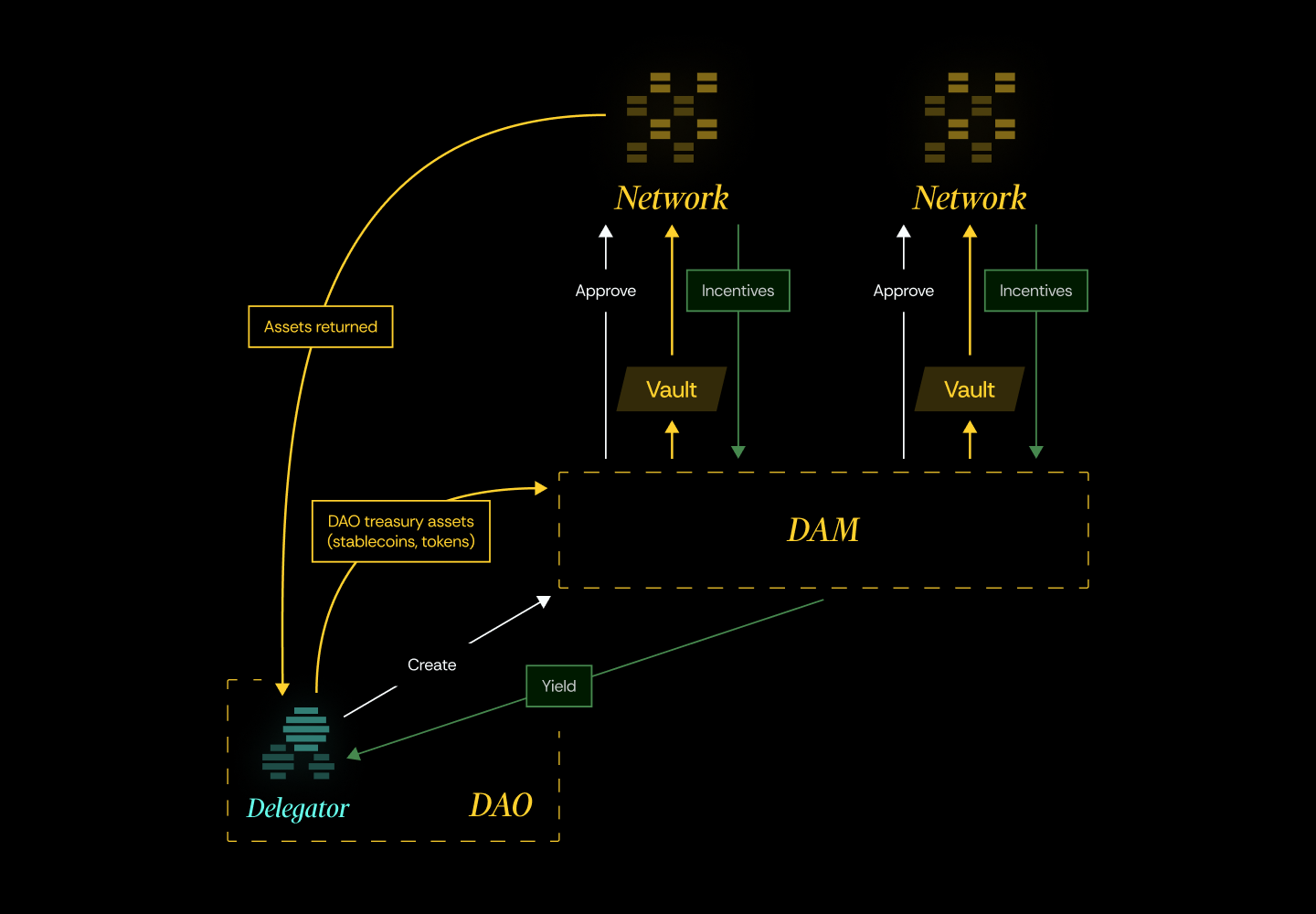

- Treasury management

Networks can source liquidity to implement advanced DeFi strategies, such as setting up vaults that offer initial rewards to attract depositors. These rewards can then be made available to Delegators in the marketplace. With a synthetic token minted programmatically to represent the flow of rewards, the protocol removes the need for Networks to act as token issuers or custodians of funds.

TVL is a key measure of growth, adoption, and success for several DeFi projects. Attracting liquidity quickly can be challenging, but Nektar enables Networks to join the marketplace and get exposure to Delegators at scale. They can offer competitive yields, quick redemption, and a transparent risk profile with mitigation strategies to bootstrap initial TVL. This use case notably does not require Operators to supply hardware.

DAOs can maximize returns on idle assets like stablecoins or protocol tokens, while maintaining custody of their treasury. The first step is to setup own DAM, which they manage directly, and delegate assets to it. Then, they can access a range of yield-bearing opportunities, customizing allocation and managing risk through programmatic controls. This setup offers real-time analytics and on-chain reporting to monitor performance while retaining flexibility to withdraw or reallocate funds as needed.

Some Networks use Nektar to incentivize assets staked within their own protocols. These assets are often sourced through Nektar and initially provided by Delegators. Networks can distribute rewards for staked assets of any type, allowing projects to maintain custody on their own platform while Nektar manages the reward flow. This creates a streamlined, flexible incentive model for liquidity provisioning.